Sound Vision consulted Br. Ahmad Sakr to find out about some of the frequently asked questions about Zakat definition and their answers. Ahmad Sakr studied Islam in Lebanon for 12 years with 20 different scholars form all parts of the Middle East. He learned Quran, Hadith, Fiqh, Seerah and Dawa from them.

Sakr is also director of the Islamic Education Center in Walnut, California.

These are the questions and answers he has given. (Please note that Imams differ in detail of some of the answers):

Question #1: What is Zakat-ul-Fitr?

Zakat -ul-Fitr is for fasting Muslims to give food or money on behalf of fasting people. The food or money is equal to one day's meals for one person. The head of the family pays this amount on behalf of each person in the family. If he is responsible for his mother and father, then he has to pay Zakat ul Fitr for them too.

If a person cannot fast permanently in the month of Ramadan (for instance, because of illness) they have to pay Fitra for each fasting day.

Question #2: Who is qualified to receive Zakah?

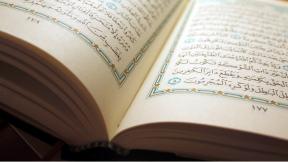

The Quran describes eight categories of people who are to receive Zakah in Surah 9, verse 60. "As-Sadaqat (here it means Zakat) are only for the Fuqara and Al-Masakin and those employed to collect the (funds); and to attract the hearts of those who have been inclined (towards Islam); and to free the captives; and for those in debt; and for Allah's Cause, and for the wayfarer; a duty imposed by Allah. And Allah is All-Knower, All-Wise."

Ahmad Sakr elaborated on these categories:

1. The poor (Fuqara)-this refers to someone who has no income

2. The needy (Masakin)-this is someone who for instance, may have a job, a house and a car, but their income is below the minimum requirement.

3. Employees of the Zakah. This category is sub-divided into the following:

- the group of people who are social services workers who go into the community to evaluate who is Faqeer and Miskeen.

- those who collect the Zakah money

- the accountant of the Zakah money

- investors who increase the share of the Zakah

- the clerical worker or secretary who puts the files in order

- those who will deliver Zakah to the ones who need it

- the outside auditor.

4. Sympathizers

These are those people who might enter or who have already entered Islam. Anyone we feel are good friends or ours (non-Muslim or new Muslims) we give them a gift from the Zakah money.

5. To free slaves

Riqab is the term used to describe the group of people who are slaves. The Zakah money is used to free the slaves. Sakr stresses that Islam did not invent slavery, but it gradually abolished it.

6. For the Gharimeen-those who are in debt

Zakah money is used to pay off debts but these people are not living in luxury, they are living a normal life. For example, someone who has gone bankrupt because of job loss and is overloaded with debt.

7. Fee Sabeelillah (for the Cause of Allah)

This can be anything for the love of Allah. Sakr gave the following examples:

a. for the employment of a Daiyah, Imam, or religious teachers to do Dawa

b. building Islamic schools

c. building Muslim clinics and hospitals

d. providing money to young men who want to marry but cannot afford Mahr

e. to assist poor travelers

f. to establish water springs on streets for those walking or travelers

(please note, these last three things were done by Khalifa Umar ibn Abdul Aziz)

g. to defend Muslims who are under attack

h. For television, radio or newspaper project aimed at doing Dawa

i. to help someone publish a book for Dawa

j. to pay for the studies of a student..

8. Ibn as Sabeel

This refers to a traveler, for instance who has lost his wallet and has to get back to his home.

Sakr stresses that this has to be verified to see if this person is really telling the truth, since there has been at least one case of a man claiming to be a lost traveler in North America who has stolen thousands from Muslims claiming to be a traveler of this type.

Question #3: How much Zakah do we give?

The amounts are the following:

2.5 percent-on annual savings that are Zakatable

5 percent-on agriculture being taken care of by a farmer who is planting and irrigating from his own money. During harvest time, he pays five percent from the total crop.

10 percent-on a farmer's product if it is being irrigated by rain

20 percent-on resources like oil or precious metals (i.e. gold, silver) which you find on a piece of land that you own. Sakr notes that this is "your property, no one has the right to nationalize it". You would pay 20 percent on what you produced in one year.

Question #4: Do I pay Zakah on my house and car

No, as long as you have one house, whether you have paid it off or not. If you have a second house for investment purposes, this is Zakatable. You would pay 2.5 percent on the total saved from the house. This excludes what is spent on maintenance or property taxes and insurance.

It's the same thing for a car. If you are renting a car to someone, this is considered a business entity, therefore, it is also Zakatable at 2.5 percent.

Question 5: Are businesses Zakatable?

First of all, the business should be Halal.

There are three opinions amongst the scholars:

- If a businessman earns a certain amount from his business, whatever he saves after taking care of his family's needs and his business expenses, he pays Zakat of 2.5 percent on what he has saved.

- A businessman has to pay Zakah on the commodities in his store. This would require evaluating the purchasing power of the commodity and then paying 2.5 percent on this amount.

- Everything is from Allah and everything goes back to Allah. The more you give on your commodities, the better, and it does not have to be 2.5 percent.

Question #6: Should Zakah be paid only once a year?

The early Muslims actually paid Zakah everyday instead of paying in a large bulk once a year.

Some scholars have advised that we plan in advance for our Zakah because we might die and our inheritors may not pay the Zakah we owe.

Another group of scholars say for businesses, you should pay in advance. The way you would do this is by estimating how much business you will make and pay 2.5 percent.

If you decide to pay Zakah daily, give a specific amount to one of the eight categories, but nobody but you and Allah should know that you are giving, since some will feel it demeaning and insulting.

Question #7: Should Zakah be paid in Ramadan

Most Muslims prefer to give their Zakah in Ramadan because there are more rewards for doing so, but it is not necessary to pay Zakah in this blessed month.

Sakr noted that Muslims are in need throughout the year, not just in Ramadan, so we can benefit Muslims by paying other times of the year as well.

"The Hand (3950973346)" by Alex Proimos from Sydney, Australia - The HandUploaded by russavia. Licensed under Creative Commons Attribution 2.0 via Wikimedia Commons - http://commons.wikimedia.org/wiki/File:The_Hand_(3950973346).jpg#mediaviewer/File:The_Hand_(3950973346).jpg

Comments

Answer to the commentsExceeding One's Basic NeedsProperties owned to meet one's basic requirements such as houses, work tools, machines for industry, means of transport, and furniture are excluded from Zakah. The same applies to the money dedicated to the repayment of debts, since the debtor is in need of this money to relieve himself from imprisonment and humiliation. This leads to a conclusion that the money kept to meet the basic requirements is exempted from Zakah

Location

Dear Sir, I have a question that I got mortgage from a bank to buy a home. I still have to pay 47000 pounds plus I have extra loan of 12000 pounds which I am paying monthly instalments. I am paying interest (which I know is wrong Islamically) on both of them so my question is that how much ZAKAT I have to pay coz I do have some savings of 3000 pounds but if I take into account the mortgage and loan then my account is actually in negative.RegardsWahab Ahmed

Location

Pages

Add new comment