As a Muslim who bows his head to his Creator it is a serious question: How to obey Him? In a world that revolves around interest (Riba). What is Riba? A world that runs on it. Banks, financing, mortgage, all involve interest. There are millions of Muslims and non-Muslims who live without interest. This article discusses practical ways of living a successful life here without compromising success in the hereafter.

1. Interest from Credit and credit cards

Credit cards are the pillar of consumerism. They are also based on a system of interest-buy now, pay later, and the later you pay, the higher the interest.

I suggest that you send your credit card back to the company in two pieces.

If you still owe money, they will continue to send you bills. Plan now to make a final payment soon. Pray that Allah liberates you from this burden.

If you are sure that you must have a credit card, pay the bill in full as soon as you receive it. If you wait for the due date, it is likely that you will forget once in a while and end up paying interest on it. Since interest is forbidden, we must avoid it.

A Muslim forgot to pay his bill on time and ended up with finance charges on the next bill. He called the service representative, saying that he had always paid his bills in full and on time.

This was a mistake and he wanted the finance charges removed. It did not not take long for the service agent to check his record and delete the finance charges.

Another Muslim whose request for the same thing was denied, wrote a letter explaining that he had paid his bills on time in full for the last seven years. An excellent credit history.

He said: If you cannot remove the finance charges which I have incurred this time then maybe I need to take my business somewhere else. He made it clear that his position on interest was not to be compromised. With his letter he enclosed his Mastercard in two pieces. Within three days he received a call from the card issuing company consenting to his position.

They sent him a new card with the same credit line as before. Although the credit card contract obliges you to pay interest, your credit history helps you to take a stand for your belief.

2. Bank Accounts

Banks are the center of the interest-based economy.

Conscientious Muslims opt for a checking account instead of an interest-bearing account. This is also the reason why Islamic organizations and Masjids meet their banking needs through checking accounts. Certainly the bank is benefiting from your money but this is a compromise and you have little choice.

Although there are 50 Islamic banks offering banking services in 23 countries, including a few Western non-Islamic banks which have Islamic windows, none of these banks are available in the United States yet.

It is interesting to note that one in five American families, i.e. 17 million families, do not have a bank account. If they receive a check they cash it through a currency exchange. If they have to pay someone they get a money order from the post office. A majority of people in the world, in fact, live without a bank account.

3. How to deal with the interest you already own

If you have an interest-bearing account which you would like to close now, or the IRS has sent you a check with interest, or you owned a bond and you want to sell it now to get away from interest. I congratulate you on your decision.

Give the amount of interest to any poor person. Do not spend a single penny on yourself.

It is Haram for you but not for the poor and the needy. Some Masjids have a special account to dispose of this money for the poorest of the poor. Although some scholars recommend leaving the interest money in the bank, I would not give the banks one penny. True, it is not my money. But it is not theirs either.

4. How to deal with the interest which you owe

One Muslim was asked to pay interest by the IRS because of some problems on his tax return. His secretary told the auditing agent that her boss neither paid nor took any interest since he was a Muslim. The secretary was a non-Muslim who knew the Islamic position. When the secretary remained undeterred on the issue of interest, the IRS agent asked if she could give any references. She showed him the book which contained the Quranic verse prohibiting interest.

The IRS agent had to consult his supervisor-Guess what? He won. Well, the secretary won since the boss didn't know yet what a fight she-a non-Muslim secretary-was putting up with the IRS, knowing the belief and character of her boss. He did not have to pay interest to the IRS on religious grounds.

A Muslim physician was charged interest on a construction job because he inadvertently delayed payment of the bill for one month. He wrote to apologize for the delay and informed the authorities that Islam did not allow him to pay or receive interest on any transaction.

Not only were the interest charges removed, but an opportunity for Dawa came up. Taking a stand with sincere motives pays in this world and in the world to come.

If you owe interest through a legal contract, get out of the deal by paying off as soon as possible.

Dua, budgeting and planning is important in achieving this goal. There are thousands of Muslims in America who have done this. You are not alone. Allah will give Barakah in this right decision. The hardship you will go through because of this decision will be, Insha Allah, a sort of purification to seek Allah's forgiveness of past mistakes.

5. Buying a house

Owning a house is the American dream.

But the fact is that about one in three families in America, or 28 million families, do not own a house. Buying with financing is an option made easy since everyone does it.

It is not only Haram to buy anything through interest-based financing, it is, in many cases, non-economical and bound to lead to headaches. Hundreds and thousands of people lose their houses every year since they spend before they earn through the financing system. And when you lose in attempting the American dream, you lose big.

You even lose what you had already paid for.

So why not think of not losing on the Day of Judgment by opting for a simple life here.

I know a Muslim sister who, before accepting Islam, used to be a real estate agent and was married to another real estate agent. She not only lost her dream hose but suffered the breakup of her marriage as well. Now a Muslima, she lives in a mobile home in a mountainous countryside. She now deals in interest-free real estate transactions only. She feels that her life is simpler and more comfortable now.

Ask yourself these questions

Non-financing options are difficult but possible. However, do ask yourself some hard questions before you decide to buy a house:

Is it absolutely necessary that you buy a house even though you cannot afford it?

Is it necessary to buy a house which is beyond your means?

Is it wise to pay four times the amount of the actual price of the house just to own it now?

Is it not cheaper and headache-free to live in a rented apartment than to own a house where you do not have to worry about snow shoveling, lawn mowing, repairs, rising property taxes, etc.?

Have you made a budget for yourself?

Are you sure you are going to keep the income which you are counting on to buy the house?

Do you have enough of a financial cushion for any and every emergency?

After this analysis, if your answer is still yes, you must buy a house, then consider some of the interest-free options.

Make a budget which will allow you to save more money. Involve every one in the family in the process of saving money. The more money you can give as down payment, the better your chances of a contract which doesn't involve financing.

Do adequate research before you end up with any real estate agent. Read books about it. Seek friends' assistance who have bought houses without mortgage.

I know people who own good houses in safe neighborhoods for as little as $10,000 and $20,000. They were able to find good deals because of good

research.

As well, their firm anti-interest commitment made them look harder into other options. One of the neighbors told a new homeowner that he wanted to buy the same house for a long time but could not figure out whom to approach. The house had been advertised for six months in a newspaper. Information is certainly power.

HUD homes

Housing and Urban Development (HUD) houses are announced at least twice a month by the federal government for auction. They are good houses, which you can buy at 50 to 60 percent below market price.

In Chicago, where median price of a single family home is $116,000, I know at least six people who have bought their houses in the $10,000 to $30,000 range with three bedrooms and a 2,000 square foot lawn.

If you can save enough money or can get an interest-free loan for two or three years through friends and relatives, you can buy a house for cash. Buying for cash makes your offer more attractive to some sellers. You will be able to get a better deal.

One Muslim I know was able to reduce the asking price by 14 percent because of his cash offer. Since it is a buyer's market, you may be able to get an even better deal. Muslims have developed informal co-ops in which six or seven families help one to buy a house on a cash basis. They develop a personal loan contract among themselves, with witnesses and signatures.

Most of the Masjids and schools in North America are purchased without interest through collective purchasing power and good negotiation. Some Muslims have purchased apartment buildings similarly and in turn have offered them to trusted Muslims and friends on interest-free installments. Many of them, with common consent have turned the basements into a Masjid and school.

You can save the money to afford a higher down payment with a contract to pay off the rest within two or three years without interest.

The Bottom Line

If we consider Allah's Guidance to be essential for success in the Hereafter, then the struggle to stay away from interest despite the prevailing system is our way of achieving Allah's pleasure. I agree that it is difficult. But Allah promises Jannah in the life to come which is everlasting.

The example of this world compared to the world to come, as the Prophet (peace and blessings be upon him) said, is like a drop of water to an ocean.

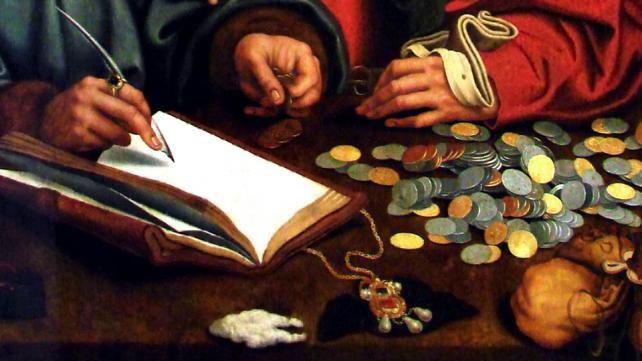

Photo Attribution: http://commons.wikimedia.org/wiki/File:Les_compteurs_d%27argent_Nancy_3018.jpg

Comments

Riba

I would agree with you. Asking devout Muslims to take out expensive sharia compliant copies of mortgages and loans, more expensive so as to pay the sharia boards is exploitation!

Location

Re

Fine to have that option. But two things you can either write up an article or show some links, that demonstrates what your critique is.

Location

My understanding of Riba is that it is not limited to a transaction type only, however it is a System. In a true Islamic Environment, there should not be any need of accumulating money, as muslims are advised to take care of the needs of other people in the society. Contrary to it, when we tend to save money and then we want to see it multiplying, thus we look for a system or investments where we can see it growing only. We even do not lend it to someone unless we have any "interest". In simple terms, we choose from Islam what we like and then want to implement it in a an environment which is non-islamic. This is a root cause. Salam, wa rahmat Ullah

Location

Really helpful article ... i like the tone which is to help people resolving this issue instead of standard approach stating that it is just forbidden and you must avoid it :)

Location

Riba is an actual/real i.e., quantitative excess. USA $ is no more stable and do not qualify as a unit of Account technically/Shariah perspective. For Free floats it is real interest that is same as Riba. All our efforts need to be directed to ensure Riba i.e., real interest free dealing. We do no good trying to keep dealing free from nominal interest as it harms the righteous and lead to corresponding gain to interest seekers.

Location

As-salaamu alaykum,really helpful, jazakAllah Khair.

Location

Could one or more people buy a house and split ownership into shares. Then one or more of the people live in the house and gradually buy out the other share owners based on the value of the house at the time each share is purchased. For example, if a house is purchased for $100,000 by ten people with each person buying 10 shares for $1,000 each. One of the people lives in the house. Then after 3 years the house is appraised at $150,000 and the one person living in the house buys out one of the others' 10 shares for $15,000 leaving 9 owners, 8 owning 10 shares each with a value of $1,500 per share and one owning 20 shares worth $1500 each. 3 years later the house is appraised at $180,000 and the one living in the house buys out another 10 shares at $1,800 each ($180,000 value/100 original shares) so there are only 8 owners left, the one living in the house now owns 30 shares and 7 others owning 10 shares each. This would go on until the one living in the house buys out the remaining owner and then completely owns the house without having paid any interest and at the same time the other 9 original owners have at least earned some income through the gains in the appraised value of the house but not through earning interest. Would this be permissable under Islam?

Location

Appreciated the credit advice very much. Studied Islam for a time and admire many aspects of it and began practice it, but found I continue to really believe Jesus voluntarily died for our sins. Appreciate my Muslim friends, and hope our world can be a place where the sincere and genuine of each religion can work for the good of all. Appreciate this article on wise use of money.

Location

happy for the information and i will have spread to my friends.

Location

It is a nice article to read

Location

Pages

Add new comment